The cost of a diamond is based on color, clarity, carat weight, cut, certification and seller markup characteristics.

It is important to remember that since there is a limited supply of large high quality diamonds, rarity drives the cost equation. As a shopper you have to understand your own motives for purchasing a diamond. If you are the type of shopper who must have the top of the line in cars and expense is no object, you probably will want a VVS clarity and D-F color diamond. You feel you can afford to pay a premium for rarity and prestige, even if you can’t see the difference. On the other hand, if you only want to invest in the quality you can see, VS2-SI1 clarity and G-I color will have similar beauty but are less rare and therefore less costly.

It is important to remember that since there is a limited supply of large high quality diamonds, rarity drives the cost equation. As a shopper you have to understand your own motives for purchasing a diamond. If you are the type of shopper who must have the top of the line in cars and expense is no object, you probably will want a VVS clarity and D-F color diamond. You feel you can afford to pay a premium for rarity and prestige, even if you can’t see the difference. On the other hand, if you only want to invest in the quality you can see, VS2-SI1 clarity and G-I color will have similar beauty but are less rare and therefore less costly.

As with any shopping, you should be seeking value which is the relative measure of what you paid compared to what you received. Diamonds with high prices can be good or poor values depending on how they satisfy your needs. Likewise, diamonds with low prices can be good or poor values depending on whether you will be thrilled with the purchase. The prices for diamonds are based more on rarity than beauty. There are high price premiums for high clarity grades that have no impact on the appearance of the diamond. In particular, there is a very large premium for D color and Internally Flawless where the price is about double that of VS1 or VS2 clarity diamonds that look the same to the eye.

As with any shopping, you should be seeking value which is the relative measure of what you paid compared to what you received. Diamonds with high prices can be good or poor values depending on how they satisfy your needs. Likewise, diamonds with low prices can be good or poor values depending on whether you will be thrilled with the purchase. The prices for diamonds are based more on rarity than beauty. There are high price premiums for high clarity grades that have no impact on the appearance of the diamond. In particular, there is a very large premium for D color and Internally Flawless where the price is about double that of VS1 or VS2 clarity diamonds that look the same to the eye.

The challenge for you as a diamond shopper is to find quality diamonds at low prices. Many retail stores carry low quality diamonds with low price tags and hope their customers are not knowledgeable and easy prey to impulse buying. By contrast, we help you find the best quality and size for your budget and work hard to find diamonds with great cut so you will have wonderful sparkle and brightness.

Advice: Because the price-per-carat can vary significantly between weight categories, it makes sense to shop for diamonds that weight just under the half-carat and full-carat weights. For example, the price difference between a 1.0 carat and 0.95 carat SI1-H could be greater than $1000 with no visible difference in size. However, now that more customers know about this price characteristic, there is more demand than for supply for these diamonds. It is very hard to find a well cut round diamond in the 0.95-0.99 carat range, but there are great values to be found in the 0.90 to 0.95 carat range. There are also great values in the 1.30-1.49 or 1.70-1.99 carat range.

Sale Prices Not Necessarily Low Prices

Once you have targeted the grade and carat weight of a diamond that is right for you, the remainder of the cost equation depends on how much markup the retailer has put in the price. For a diamond merchant to stay in business, they must set a price that covers the cost of the diamond plus the cost of doing business. The lower the overhead cost, the lower your price should be.

Typical retail stores put a high price on their inventory and they give you a “discount” because you are such a valuable customer or are such a skilled negotiator. We don’t play that game because we think you deserve the best price up front.

Typical retail stores put a high price on their inventory and they give you a “discount” because you are such a valuable customer or are such a skilled negotiator. We don’t play that game because we think you deserve the best price up front.

At Diamond Source of Virginia we work hard to find the very best sources of diamonds and operate with extremely low overhead. The result is we can provide the best diamonds for less money. Check our Price Calculator to the right to see estimates of the prices for diamonds with various shape, color, clarity and weight characteristics.

Rapaport Price List

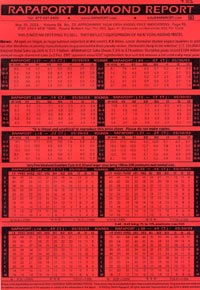

Martin Rapaport rose to fame in the diamond industry by establishing a regularly published Diamond Report which is one of the primary sources of diamond prices and information for the diamond trade.

Martin Rapaport rose to fame in the diamond industry by establishing a regularly published Diamond Report which is one of the primary sources of diamond prices and information for the diamond trade.

The pricing parts the Diamond Report are the Rapaport Price Lists (often referred to as the “Rap Sheet” the “Rap List” the “Rap Price” or simply “Rap”) provide estimates of diamond prices. These Price Lists are often thought to be “wholesale” prices since they are used by the wholesaler and retailers but are not really wholesale prices. They are simply a base that diamond dealers use as a starting point from which to negotiate. Retailers attempt to purchase diamonds at some discount below the Price List but actual prices are impacted by many factors.

Note: Prices displayed on this simulated list are not correct and are for illustrative purposes only. Rapaport Prices Lists are copyrighted and constantly changing. To learn more about the Rapaport report, visit www.diamonds.net.

The prices indicated on these Price Lists are expressed in $100’s per carat for various combinations of shape, color, clarity, and carat weight. There is a different table for each shape and carat weight range and the prices produce a matrix within each table based on color and clarity. For example, the diamond price per carat for a 1.25 carat round diamond with F color and VS2 clarity would be 180. Therefore the diamond price would be 1.25 carats x 180 x 100 = $22,500.

The prices indicated on these Price Lists are expressed in $100’s per carat for various combinations of shape, color, clarity, and carat weight. There is a different table for each shape and carat weight range and the prices produce a matrix within each table based on color and clarity. For example, the diamond price per carat for a 1.25 carat round diamond with F color and VS2 clarity would be 180. Therefore the diamond price would be 1.25 carats x 180 x 100 = $22,500.

Diamond traders use the Rap list as a basis from which discounts are offered between cutters, wholesalers and retailers. Because cut, length to width ratio, fluorescence, polish & symmetry are not included on the list, there can be big differences between diamond prices even if color, clarity and carat weight are the same. Other factors that impact actual prices for diamonds include payment terms, item location and the demand for that specific stone’s shape-clarity-color-carat combination. If there is only one stone on the entire wholesale market with certain characteristics, its price will likely be higher than if there are hundreds to pick from.

For the consumer trying to use these prices, it is not as simple as it would appear. For a given shape, color, clarity and carat weight, the price of diamonds can vary dramatically. For example, a diamond with a certain shape, color, clarity and carat weight that reflects a Rap Price of $10,000 can cost a retailer from $4,000 to as much as $11,000 depending on the cut and other factors not considered in the Rap Sheet.

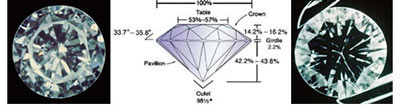

Below are two diamonds that have bad cut and should be priced at a fraction of what an ideal cut diamond would be with the same color, clarity and carat weight. On the left is what is known as a “fisheye” (pavilion too shallow). On the right is what is known as a “nailhead” (pavilion too deep). These are just two examples of what the Rap Sheet does not tell you about the diamond’s true value.

When a client comes to us and says they want to buy diamonds at some percentage below Rap, we immediately know they have been taken in by some retailer who has been selling them cheap diamonds at some big discount below Rap list. By cheap diamonds, I mean diamonds that have poor cut, high fluorescence and/or undesirable finish ratings. Some of the best cut diamonds are sold by cutters at close to Rap list, so do not expect to find these great diamonds at 30% or 50% below Rap. If diamonds are sold retail at big discounts below Rap list, they probably have some characteristics that are not the most desirable so buyers beware.

Keep in mind that certified diamonds almost always cost more than uncertified diamonds. Beware of a jewelry store who sells uncertified diamonds at substantially lower prices than certified diamonds because they are likely misrepresenting the quality of the uncertified diamond. Exaggerating a couple of clarity and color grades makes what sounds like a great deal, really just an expensive mistake.

If the deal sounds too good to be true, then it probably is!

Diamonds Below Wholesale

As a consumer, you can never buy diamonds “below wholesale.” By definition, you are buying at retail. That retail price might be less than half of what another jewelry store is charging, but the fact is both prices are retail prices. Do not be fooled by the misleading words or the hint that you are getting an unbelievable deal.

As a consumer, you can never buy diamonds “below wholesale.” By definition, you are buying at retail. That retail price might be less than half of what another jewelry store is charging, but the fact is both prices are retail prices. Do not be fooled by the misleading words or the hint that you are getting an unbelievable deal.

It is illegal to advertise as “Wholesale to the Public” so do not do business with someone who must resort to illegal marketing to get your business. It is also illegal for retailers to advertise a retail price as a “wholesale” price, when they are not selling at prices paid by those purchasing directly from the wholesaler.

Wholesalers and retailers are in business to make money so they can stay in business. Knowledgeable sellers of diamonds do not sell them at a loss. The challenge is to find retailers with very low overhead so they can sell at prices close to what they paid the wholesaler. The more knowledge you have about the diamond and what prices are for similar diamonds from other sources, the better chance you have of getting the best diamond at the best price.

Price Forecast

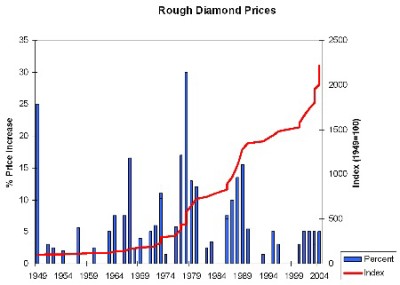

Dwindling supplies of rough diamonds coupled with increasing demand for polished gems will drive diamond prices even higher.

Dwindling supplies of rough diamonds coupled with increasing demand for polished gems will drive diamond prices even higher.

It is predicted that shortages of rough diamonds in coming years will be competing with increased demand resulting from industry marketing and branding initiatives. The resulting combination of rising prices and high advertising and marketing costs will force many firms to either consolidate or go out of business.

Diamond stocks held by De Beers and other mining companies totaled over $22 billion a few years ago. Now these levels are down to $3 or $4 billion, which is about the minimum level for efficient operations. This lack of surplus puts pressure on prices.

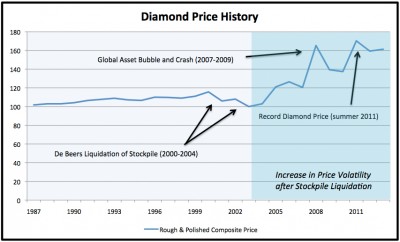

Diamond prices have been relatively stable for the past ten years but starting in late 2003 the prices have started a significant upward climb. With no major new diamond mines expected in the next five to eight years, diamond shortages will get worse as demand rises.

As the graph above shows, we are seeing diamond prices increases in recent years that are reminiscent of the peak increases seen in the late 1970’s and the late 1980’s.

Diamond manufacturers and retailers are being squeezed. Consumers are demanding greater value for their money and online retailers have provided lower priced alternatives. The result is shrinking gross margins for these businesses.

The diamond industry is entering an era of fundamental change and prices can be expected to show much more volatility than in recent years.